题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

以下哪些是OTP Check的项目()

A.Fixed Value

B.Value Range Check

C.hecksum

答案

答案

C、hecksum

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.Fixed Value

B.Value Range Check

C.hecksum

答案

答案

C、hecksum

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“以下哪些是OTP Check的项目()”相关的问题

更多“以下哪些是OTP Check的项目()”相关的问题

A.工业中间投入

B.应交增值税

C.劳动者报酬

D.固定资产折旧(depreciation of fixed assets)

Securitisation proposals

One of the non-executive directors of Moonstar Co has proposed that it should raise funds by means of a securitisation process, transferring the rights to the rental income from the commercial property development to a special purpose vehicle. Her proposals assume that the leases will generate an income of 11% per annum to Moonstar Co over a ten-year period. She proposes that Moonstar Co should use 90% of the value of the investment for a collateralised loan obligation which should be structured as follows:

– 60% of the collateral value to support a tranche of A-rated floating rate loan notes offering investors LIBOR plus 150 basis points

– 15% of the collateral value to support a tranche of B-rated fixed rate loan notes offering investors 12%

– 15% of the collateral value to support a tranche of C-rated fixed rate loan notes offering investors 13%

– 10% of the collateral value to support a tranche as subordinated certificates, with the return being the excess of receipts over payments from the securitisation process

The non-executive director believes that there will be sufficient demand for all tranches of the loan notes from investors. Investors will expect that the income stream from the development to be low risk, as they will expect the property market to improve with the recession coming to an end and enough potential lessees to be attracted by the new development.

The non-executive director predicts that there would be annual costs of $200,000 in administering the loan. She acknowledges that there would be interest rate risks associated with the proposal, and proposes a fixed for variable interest rate swap on the A-rated floating rate notes, exchanging LIBOR for 9·5%.

However the finance director believes that the prediction of the income from the development that the non-executive director has made is over-optimistic. He believes that it is most likely that the total value of the rental income will be 5% lower than the non-executive director has forecast. He believes that there is some risk that the returns could be so low as to jeopardise the income for the C-rated fixed rate loan note holders.

Islamic finance

Moonstar Co’s chief executive has wondered whether Sukuk finance would be a better way of funding the development than the securitisation.

Moonstar Co’s chairman has pointed out that a major bank in the country where Moonstar Co is located has begun to offer a range of Islamic financial products. The chairman has suggested that a Mudaraba contract would be the most appropriate method of providing the funds required for the investment.

Required:

(a) Calculate the amounts in $ which each of the tranches can expect to receive from the securitisation arrangement proposed by the non-executive director and discuss how the variability in rental income affects the returns from the securitisation. (11 marks)

(b) Discuss the benefits and risks for Moonstar Co associated with the securitisation arrangement that the non-executive director has proposed. (6 marks)

(c) (i) Discuss the suitability of Sukuk finance to fund the investment, including an assessment of its appeal to potential investors. (4 marks)

(ii) Discuss whether a Mudaraba contract would be an appropriate method of financing the investment and discuss why the bank may have concerns about providing finance by this method. (4 marks)

A.$425,000; $25,000.

B.$425,000; $75,000.

C.$500,000; $25,000.

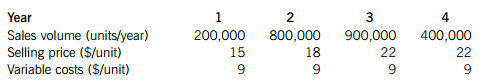

Selling price and variable cost are given here in current price terms before taking account of forecast selling price inflation of 4% per year and variable cost inflation of 5% per year.

Incremental fixed costs of $500,000 per year in current price terms would arise as a result of producing the new product. Fixed cost inflation of 8% per year is expected.

The initial investment cost of production equipment for the new product will be $2·5 million, payable at the start of the first year of operation. Production will cease at the end of four years because the new product is expected to have become obsolete due to new technology. The production equipment would have a scrap value at the end of four years of $125,000 in future value terms.

Investment in working capital of $1·5 million will be required at the start of the first year of operation. Working capital inflation of 6% per year is expected and working capital will be recovered in full at the end of four years.

Hebac Co pays corporation tax of 20% per year, with the tax liability being settled in the year in which it arises. The company can claim tax-allowable depreciation on a 25% reducing balance basis on the initial investment cost, adjusted in the final year of operation for a balancing allowance or charge. Hebac Co currently has a nominal after-tax weighted average cost of capital (WACC) of 12% and a real after-tax WACC of 8·5%. The company uses its current WACC as the discount rate for all investment projects.

Required:

(a) Calculate the net present value of the investment project in nominal terms and comment on its financial acceptability. (12 marks)

(b) Discuss how the capital asset pricing model can assist Hebac Co in making a better investment decision with respect to its new product launch. (8 marks)

A.INSERT表SET字段名=值

B.INSERTINTO表(字段列表)VALUE(值列表)

C.INSERT表VALUE(值列表)

D.以上答案都不正确

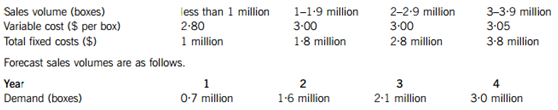

The production equipment for the new confectionery line would cost $2 million and an additional initial investment of $750,000 would be needed for working capital. Capital allowances (tax-allowable depreciation) on a 25% reducing balance basis could be claimed on the cost of equipment. Profit tax of 30% per year will be payable one year in arrears. A balancing allowance would be claimed in the fourth year of operation.

The average general level of inflation is expected to be 3% per year and selling price, variable costs, fixed costs and working capital would all experience inflation of this level. BRT Co uses a nominal after-tax cost of capital of 12% to appraise new investment projects.

Required:

(a) Assuming that production only lasts for four years, calculate the net present value of investing in the new product using a nominal terms approach and advise on its financial acceptability (work to the nearest $1,000). (13 marks)

(b) Comment briefly on the proposal to use a four-year time horizon, and calculate and discuss a value that could be placed on after-tax cash flows arising after the fourth year of operation, using a perpetuity approach. Assume, for this part of the question only, that before-tax cash flows and profit tax are constant from year five onwards, and that capital allowances and working capital can be ignored. (5 marks)

(c) Discuss THREE ways of incorporating risk into the investment appraisal process. (7 marks)

A.type="checkbox

B.value= "true

C.heck= "true

D.hecked= "checked